Think of us as an extension of your business

We work with wealth and investment managers, fiduciaries, trust companies and family offices providing custody and outsourced dealing desk services through to a fully outsourced back office solution. This enables you to focus on what you do best – managing your clients’ interests and growing your business.

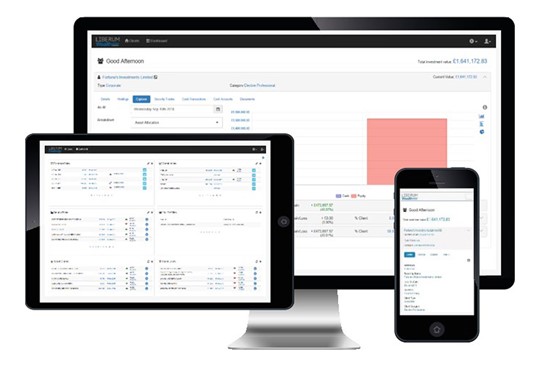

Our belief in going the extra mile for clients and common sense approach to administration, settlement, custody as well as dealing, ensures you are always in control by providing you with access through our secure online platform and by offering a direct line to our professional and experienced operations and dealing teams.

- We’re always available on the phone or on email where you’ll speak to highly experienced operations specialists who understand investments - not just a call centre

- Our high levels of service ensure stock is settled efficiently and held securely, reducing the administration burden for you

- We provide deal execution - you’ll have direct access to our experienced and expert dealing team, ensuring market trades are handled diligently, efficiently and at institutional prices

- We also provide clients with multi-currency cash and FX services

Wherever you or your clients are based in the world, our highly experienced team will deliver the level of personal service you deserve.

Focused expertise

We are focused on providing best in class custody, settlement, execution-only dealing services together with the associated administration. This focus, combined with experience of our team and our investment in technology, enables us to provide high levels of personal service while delivering value for money and institutional pricing.

We do not provide discretionary or advisory investment services and we do not take proprietary “book” positions. As such, business risk and conflicts with managers and advisers are minimised.

Comprehensive multi-asset securities servicing

If you work with other brokers we can settle trades on a Delivery versus Payment basis. In addition we can provide reporting for related tax withholding documents and foreign tax reclamation; administer corporate actions (including but not limited to stock splits, scrip dividends, mergers and acquisitions, tender offers and bond calls; provide proxy voting services and information on upcoming votes for securities held.

We provide multi-asset dealing, settlement and ongoing safe custody across a wide range of securities asset classes including:

- Globally listed equities (across both developed and emerging markets)

- Fixed income and specialist debt securities

- Collectives investments (including open-ended, closed-ended, alternative and offshore funds)

- Private investments (including private companies, private equity LPs, unlisted securities)

Account management and client reporting

We work to your specifications – if you want us to provide individual client reporting across your separate client accounts, we can. There is also potential to white label reports.

Our online portal provides 24 hour access to our reporting dashboard and our highly experienced operations specialists are always available by email or on the phone. We can also offer access to our secure web-based client portal for your clients, white labelled with your own branding.